When life throws a curveball, insurance can be a lifesaver. However, filing a claim can be stressful and confusing for policyholders.

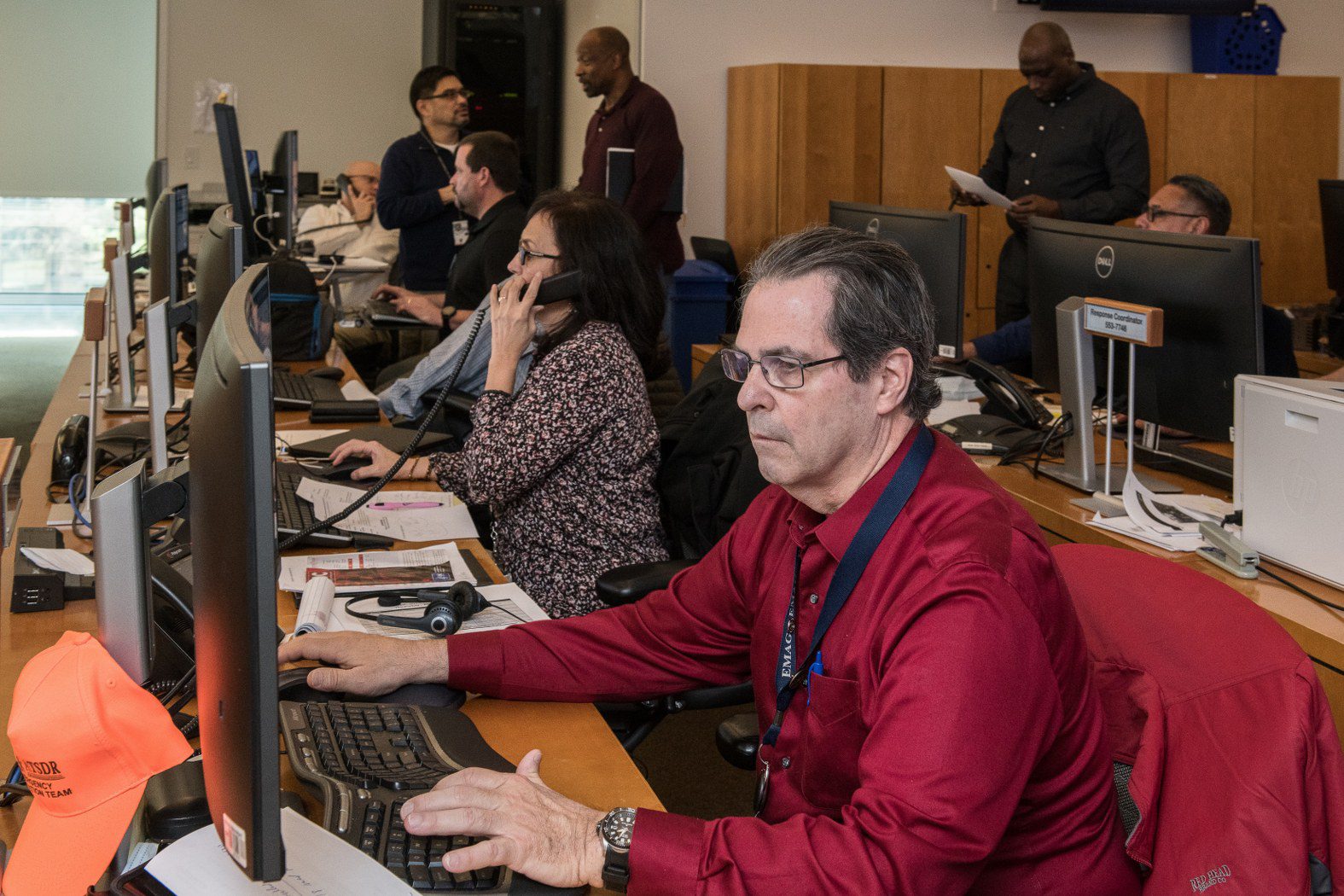

That’s why insurance call center agents are vital in providing a smooth and satisfying customer experience. They are experts in insurance policies and empathetic listeners who can comfort and guide policyholders in their time of need.

How well insurance call center agents handle claims can make or break the customer’s impression of the insurance company. Excellent service builds lasting trust and loyalty.

In this article, you will discover the best practices for insurance call center agents to deliver outstanding customer service. Don’t miss this opportunity to learn from the pros.

Understanding the Claims Process

Insurance claims cover everything from death benefits on life insurance policies to routine and comprehensive medical exams.

The insurance claims process is a series of steps policyholders follow to seek compensation from their insurance company for covered damages or losses. The process involves notifying the insurer about the incident, providing necessary documentation, evaluating the claim, and receiving a payout if the claim is approved.

When all is said and done, insurance companies must settle claims promptly.

Types of Claims Handled by Call Center Agents

Insurance call center agents are responsible for handling the following types of claims.

Health Insurance Claims

A health insurance claim is raised to cover the costs of medical expenses. Health insurance call center agents assist policyholders in navigating medical claims, understanding coverage, and addressing billing issues.

Life Insurance Claims

The nominee raises a life insurance claim in the unfortunate event of the policyholder’s passing, requiring sensitivity and compassion. Once the insurance company has verified all information, a payout is made to the beneficiary’s account.

Property Insurance Claims

Property insurance claims include claims related to property loss or damage due to vandalism, storms, firms, and natural calamities.

Homeowners/Renters Insurance Claims

Insurance call center agents can handle claims for damages to personal property, liability claims if someone is injured, and additional living expenses if the property becomes uninhabitable.

Common Challenges Faced by Agents During Claim Handling

The following are the common challenges insurance call center agents face while handling claims.

Disputed Claims

Some policyholders might disagree with claim assessments, leading to negotiations and potential disputes. Insurance call center agents must handle these situations professionally and diplomatically.

Complex Insurance Policies and Procedures

Insurance policies and procedures can sometimes be intricate, and understanding the terms, conditions, and coverage specifics may require deep knowledge. Call center agents must be well-versed in policy details to assist effectively.

Handling High Call Volumes

During times of natural disasters or widespread incidents, insurance companies may experience an influx of calls, requiring agents to manage high call volumes efficiently. Failing to answer calls may lead to frustration and dissatisfaction among policymakers.

Emotional Distress

Policyholders often contact insurance companies during distressing situations. Insurance call center agents must exhibit empathy and patience while addressing emotional concerns.

Technical Challenges

Agents often rely on software and systems to access policy information and process claims. However, technical glitches can hinder efficient claim handling.

Document Verification and Accuracy

Insurance call center agents must ensure that policyholders provide accurate and complete documentation to process claims correctly. Verifying these documents can be time-consuming, especially with a limited staff.

Insurance Call Center Best Practices for Effective Claim Handling

The following are key practices for effective claim handling.

Active Listening and Empathy

Empathy and active listening are essential skills that insurance call center agents must master to provide exceptional customer service during the claims process.

Active listening involves fully concentrating, understanding, responding, and remembering what the policyholder is saying. It ensures that insurance call center agents gather accurate information, comprehend the situation, and address the policyholder’s concerns effectively.

Call center agents should focus solely on the conversation without distractions. They should allow the policyholders to raise their concerns without interrupting to ensure they can fully express their needs.

If something is unclear, they should strive to gather more information by asking open-ended questions.

Empathy, in the context of claims handling, means recognizing the emotional impact that an incident or loss has on the policyholder and responding with sensitivity. You should acknowledge the policyholder’s feelings and let them know you understand the distress they are experiencing.

Agents should use supportive language and be patient, allowing policyholders to express their concerns and emotions without rushing or pushing for information.

Clear and Concise Communication

Clear and concise communication is crucial in the insurance claims process. Agents must ensure that policyholders understand the procedures, expectations, and outcomes, even if they are unfamiliar with insurance terminology. They should use simple, everyday language when explaining claim procedures.

Insurance call center agents should provide policyholders with precise information about their coverage, claim timeline, and required documentation. Misinformation can lead to misunderstandings and delays.

Written communication, whether via email or text message, must be clear and concise to facilitate proper documentation and follow-up. Insurance call center agents must ensure all relevant details are included, and instructions are easy to understand.

Timely Response and Follow-Up

Timely response and follow-up are crucial in providing exceptional customer service during the insurance claims process. It is important to ensure policyholders receive responses, updates, and resolutions within reasonable timeframes. This demonstrates dedication, professionalism, and commitment to the needs of policyholders.

Insurance call center agents should provide an estimated timeframe for each stage of the process, including assessment, documentation review, and payout. This helps manage policyholders’ expectations and prevents frustration.

Policyholders should also be regularly updated on the status of their claims to keep them informed, even if there are no major developments.

In cases where additional documentation or information is needed, prompt follow-up is essential. Call center agents should contact policyholders promptly to request missing information and clarify any uncertainties.

Problem-Solving and Decision Making

Problem-solving and decision-making are critical skills for insurance call center agents during the claims process. Insurance call center agents must navigate complex situations, analyze information, and make informed choices to ensure accurate and fair claim resolutions.

To make informed decisions that align with the policyholder’s coverage during claims evaluation, agents must carefully analyze the information provided, assess the policy’s terms and conditions, and consider any relevant documentation.

In cases where insurance call center agents encounter unfamiliar or complex situations, they should seek guidance from supervisors or experts within the organization. This ensures the best decision is made for both the insurer and the policyholder.

Building Trust and Credibility

Building trust and credibility is at the core of exceptional customer service in the insurance claims process. Call center agents must establish strong relationships with policyholders by demonstrating transparency, honesty, and a genuine commitment to exceeding expectations.

Insurance call center agents should strive to establish a rapport with customers to build trust. They should approach interactions with empathy, warmth, and an understanding of the policyholder’s needs. Honesty and transparency are crucial when handling claim disputes. If there is a disagreement or a claim is denied, call center agents should explain the reasons clearly and provide policyholders with accurate information to understand the decision.

Insurance call center agents must also be willing to go the extra mile to exceed customer expectations. They should be ready to assist policyholders and resolve their concerns promptly, even if it requires additional effort.

Additional Considerations for Insurance Call Center Agents

The following are other considerations for insurance call center agents.

Comprehensive Training Programs

Comprehensive training programs for insurance call center agents are critical in ensuring the professionalism, efficiency, and effectiveness of claim handling. These programs equip agents with the skills, tools, and knowledge needed to excel in their roles. This results in improved customer service, enhanced customer satisfaction, and a positive impact on the overall reputation of the insurance company.

Continuous Learning

Insurance is a dynamic industry, subject to evolving customer preferences, regulations, and technologies. Insurance call center agents should engage in continuous learning to stay abreast of these changes. This allows them to suggest relevant coverage options, provide up-to-date information, and ensure their advice aligns with the latest industry trends.

Leveraging Technology for Efficient Claim Handling

Virtual call center solutions that are powered by technology offer agents tools to enhance their efficiency in claim handling. They enhance access to information databases and streamlined communication channels.

Reliable call center agents should be able to use technology to communicate with policyholders more effectively, retrieve policy information, and track claim statuses.

Ensuring Compliance and Data Security

Insurance call center agents must uphold stringent compliance and data security standards to protect policyholder information and maintain the insurance company’s integrity. Training should emphasize the importance of adhering to legal regulations, handling sensitive data responsibly, and following internal protocols for data protection.

Conclusion

Insurance is a complex and sensitive industry where policyholders need reliable and empathetic support during their challenging times. That’s why best practices for insurance call center agents are essential for enhancing customer service, boosting the insurance company’s reputation, and creating a positive customer experience.

If you want to partner with a trusted and experienced company that can handle your claims and customer service with excellence, look no further than Always Answer.

Always Answer is a 24/7 live call answering service that has been serving small to medium businesses since 1975. We have transparent and fair pricing, innovative solutions, and friendly staff that can meet your needs.

Contact us today and see how we can help you.